Impact Goals

Collington Capital’s focus is on the impact goals most critical to addressing social inequality: poverty alleviation, better health, inclusive education, women’s empowerment, economic development and climate solutions which build the resilience of the most vulnerable. The group is active in both the United Kingdom and internationally, where its primary focus is Sub-Saharan Africa, South and Southeast Asia and Latin America.

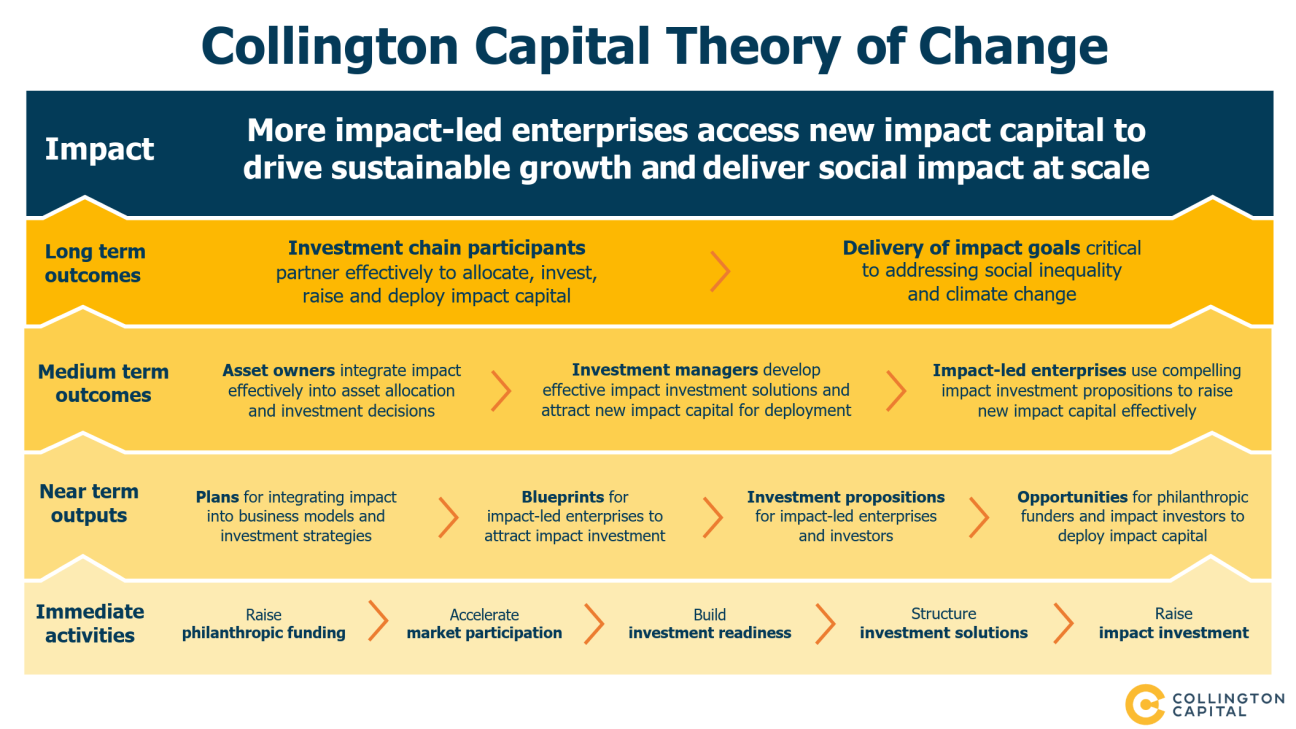

Collington Capital believes that the mainstreaming of blended finance, which brings together multiple sources of funding and investment, is critical to the mobilisation of impact capital and the delivery of social impact at scale. The group’s business model is designed to support the cross-sector partnerships which blended finance requires.

Collington Capital identifies market failures that prevent optimal levels of investment to deliver both economic and social outcomes. Then, the firm develops, and raises grant funding and investment capital for, the blended finance propositions that mitigate these market failures and enable impact capital to flow. An important objective is to enable philanthropic funding to catalyse greater flows of commercial or concessional impact investment.

The group’s pioneering structure of three distinct but integrated entities – a not-for-profit foundation, an impact advisory partnership and a regulated impact investment bank – enables Collington Capital to work across the impact investment chain.

is a not-for-profit company facilitating the development and funding of blended finance impact investment propositions. It works with donors and grantors to develop blended finance solutions which catalyse impact investment into impact-led organisations in the United Kingdom and internationally so that they can grow sustainably and deliver social impact at scale.

The foundation’s goal is to mobilise US$150mn of catalytic philanthropic funding over five years.

is an impact advisory partnership working with grantors, investors and fund managers to help them integrate impact investment into their strategies and operations and advising impact-led enterprises on building readiness for impact investment.

The partnership’s vision is for all participants in the impact investment chain to realise their potential to deliver social impact at scale.

is a recently established boutique impact investment bank authorised and regulated by the Financial Conduct Authority. The firm originates impact investment opportunities for investors, structures impact investment vehicles and raises investment capital for a select group of impact fund managers, and enables impact-led enterprises to access impact capital.

The investment bank’s goal is to raise U$350mn of concessionary and commercial impact investment over five years.

The impact investment bank collaborates with the advisory partnership, to test high-level impact investment propositions in the market and with the foundation, to raise both grant funding and investment capital into blended finance vehicles.

How we are different:

- Expertise includes both proposition advice and capital raising. The group structure includes an impact advisory partnership and an impact investment bank. This enables Collington Capital to partner with its clients on the journey from building investment readiness to raising investment capital.

- Ability to raise grant funding and impact investment for blended finance. The group’s integrated capability, through a not-for-profit foundation and an impact investment bank, enables Collington Capital to raise both grant funding and investment capital for blended finance structures.

- Global philanthropic funding and capital raising capabilities. Collington Capital aims to source grant funding and impact investment in the UK, North America, Switzerland and Singapore. The firm’s current focus is the UK where it can conduct regulated activities as an arranger of investments.

- Leadership team of impressive breadth and depth of expertise. The team includes senior people with deep knowledge of impact investing, and experience across financial services and the social sector, global capital raising and emerging market fund management.

- The culture reflects strong and genuine ethical partnership. Collington Capital has an authentic commitment to its values of a shared purpose, a hunger to learn, a spirit of generosity, trustworthy relationships and a determination to achieve excellent outcomes.